Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

financial-markets-and-productspart-1

17 Aug 2019

After completing this reading, you should be able to:

- Identify and explain the types of risks faced by CCPs.

- Identify and distinguish between the risks to clearing members as well as non-members.

- Identify and evaluate lessons learned from prior CCP failures

Types of Risks Faced by CCPs

Default risk

A clearing member may default on one or more transactions. Following a default event, a host of other problems may come up. These include:

- Default or increased distress of other members because of high default correlation

- Failed auctions, leaving the CCP with no choice but to impose losses on members

- Resignations because initial margins and default funds have to be returned to resigning members, the loss could be felt by other members.

- A worsening reputation – a default event would also injure the reputation of other members with close ties to fallen members.

Non-default events

Such events include:

- Internal/external fraud

- Operational losses

- Investment losses

- Losses due to litigation

Note that that non-default and default losses may be correlated. The default of a member might cause market disturbance and increase the likelihood of operational or legal problems.

Model risk

CCPs are exposed to model risk because of the use of a range of margining methods. Of note is the fact that there isn’t a reliable, dependable platform on which OTC derivatives can be observed. Valuation models may use subjective assumptions.

Liquidity risk

A CCP faces liquidity risk due to the large cash flows frequently transacted. In addition, the CCP must also choose its investments wisely so that it does not inadvertently create a shortage of cash necessary for day-to-day running.

Operational and legal risk

Centralization of various functions fosters efficiency, but on the downside, it creates a fertile ground for operational bottlenecks. For example, the CCP may have to contend with frequent system failures due to heavy traffic. What’s more, segregation and the movement of margin and positions through a CCP is prone to legal risk, depending on jurisdiction.

Other risks include custody risk in case of failure of a custodian, wrong-way risk, foreign exchange risk, concentration risk, and sovereign risk.

Risks to Clearing Members and Non-members

Risks to members:

There are several ways through which a clearing member can experience CCP-related losses:

- Forced allocation

- CCP failure

- Auction costs

- Default fund utilization

- Rights of assessment

- Tear-up

Prior to gaining membership, there are several mechanisms through which a prospective member can assess the risks faced by a member of the CCP. Such mechanisms may involve scrutinizing:

- The membership criteria

- Investment policies

- Default management policies

- Operational capacity

- Capital requirements

- The number of alternative CCPs and their credit ratings

- Initial margin and default fund contributions

Risks to Non-Clearing members:

Non-clearing members who clear indirectly through a CCP are usually faced with different risks, most of which may closely resemble those of clearing members. However, non-clearing members may have an additional layer of protection:

- If a clearing member defaults, clients may be safe provided their clearing member is in compliance with the CCP’s requirements and in good financial health.

- If a clearing member defaults, the CCP may safeguard the interests of non-clearing members through margin segregation and portability.

- Since non-clearing members do not contribute toward the default fund, their exposure to the CCP is indirect.

Lessons Learned from Prior CCP failures

In the last four decades, we’ve had several high-profile CCP failures and near-failures. Common sources of these failures include:

- Insufficient margins and default funds

- Large movements in the price of the underlying

- The failure to update initial margin requirements to reflect changing market conditions

- Operational problems associated with large price moves and system-crushing trade volumes

- Liquidity strains

Some of the lessons we can learn from these past failures include:

- Operational risk must be mitigated at all costs. Failure to act is never an option

- Variation margins should be recalculated frequently

- CCPs should have access to external sources of liquidity. They can easily default, not because they are insolvent but simply because they are illiquid in the short-term.

- CCPs should endeavor to monitor positions continuously and act quickly whenever there are large moves

Question

Which of the following ismost likely associated withnon-default losses?

- Failed auctions

- A worsening reputation

- Internal/external fraud

- Resignations

The correct answer is C.

A clearing member may default on one or more transactions. Following a default event, a host of other problems may come up. These include:

- Default or increased distress of other members because of high default correlation

- Failed auctions, leaving the CCP with no choice but to impose losses on members

- Resignations because initial margins and default funds have to be returned to resigning members, the loss could be felt by other members.

- A worsening reputation – a default event would also injure the reputation of other members with close ties to fallen members.

Internal/external fraud is in the category of non-default events.However,non-default and default losses may often be correlated.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

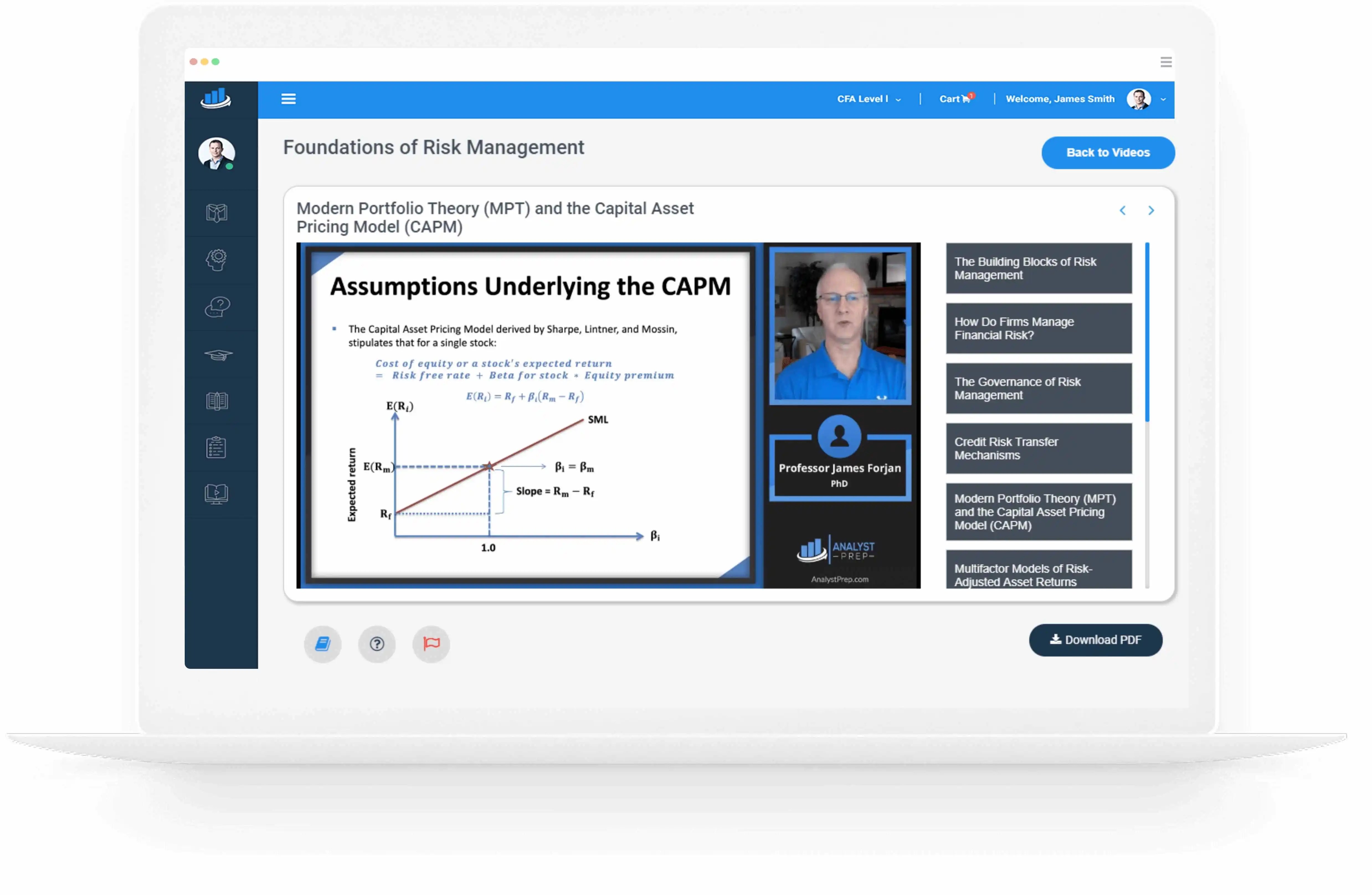

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts

Leave a Comment

You must be logged in to post a comment.